Meta's Q1 2025 Earnings Show Strong Ad Revenue, AI Focus

Meta Platforms reported strong Q1 2025 earnings, with a 16% year-over-year revenue increase to $42.31 billion. The company exceeded expectations and projects Q2 revenue between $42.5 billion and $45.5 billion despite a dynamic macro environment. See the full earnings statement.

Ad Revenue Growth Driven by Online Commerce and AI

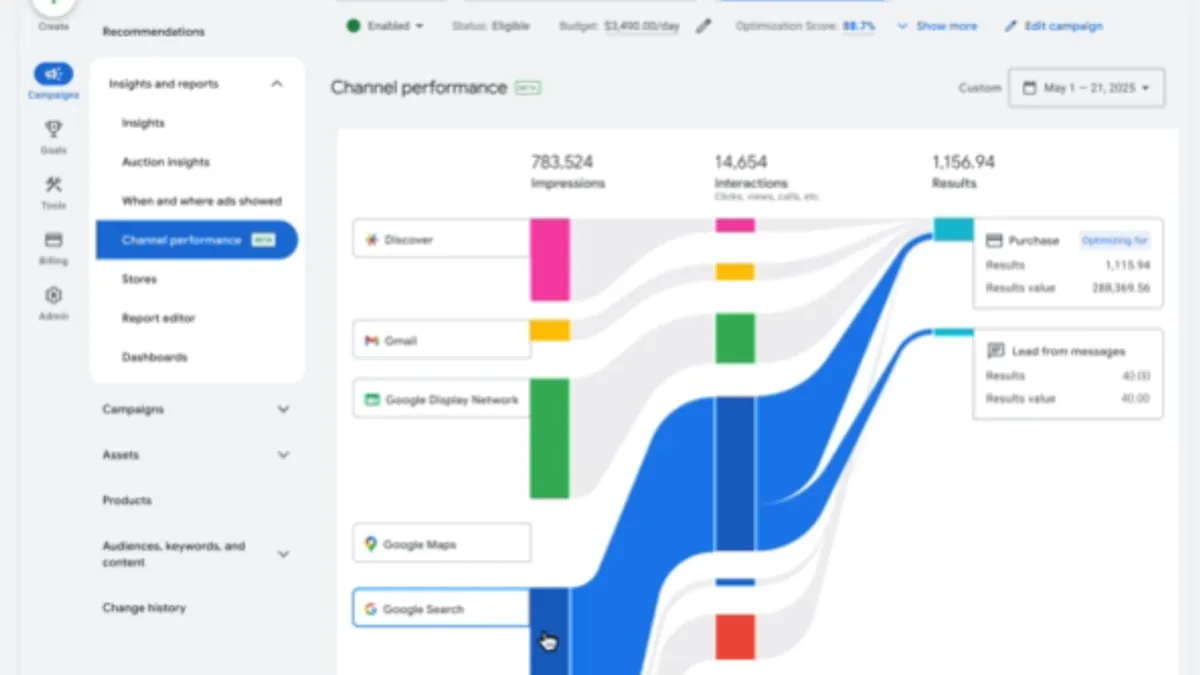

Ad impressions across Meta's family of apps rose 5% year-over-year, with average price-per-ad increasing 10%. Daily active people (DAP) reached 3.43 billion in March 2025, a 6% year-over-year increase. Online commerce was the largest contributor to ad revenue growth. However, reduced spending by Asia-based e-commerce firms in the U.S. impacted growth, potentially due to ongoing trade disputes.

Meta's focus on AI is driving improvements in advertising performance. The Generative Ads Recommendation Model, introduced in Q1, increased ad conversions by up to 5% in early Reels tests. The model is now being rolled out to other platforms. Meta also launched a new incremental attribution feature, showing a 46% lift in incremental conversions during testing.

Our goal is to make it so that any business can basically tell us what objective they're trying to achieve like selling something or getting a new customer and how much they're willing to pay for each result, and then we just do the rest.

CEO Mark Zuckerberg discussed this on the earnings call.

Regulatory and Economic Headwinds Remain

Despite strong ad performance and AI advancements, Meta faces regulatory challenges. The European Commission recently ruled Meta's ad-free subscription model non-compliant with the Digital Markets Act. Learn more about the ruling. Meta plans to appeal the decision, but acknowledges potential negative impacts on its European business.

In the U.S., Meta faces an antitrust case that could lead to the breakup of the company. Read more about the antitrust case. These regulatory pressures, combined with economic uncertainty and continued losses from Reality Labs, pose significant risks.

Mike Proulx, VP and Research Director at Forrester, predicts Meta may shutter its metaverse projects by the end of 2025 to focus on AI initiatives. He believes this would strengthen Meta's position as a growth company, especially if the antitrust case negatively impacts its family of apps.